Enter: income share agreements, or ISAs, which have quickly become a popular form of alternative financing for students. Income share agreements, like our Pay-It-Forward model at Climb Hire, allow you to enter a training or education program with an agreement to pay back a percentage, or a set amount, of what you make in the future.

Today, we’ll talk more about income share agreements and their benefits, as well as things you should know before agreeing to one. Read on to learn more!

What Are Income Share Agreements?

Income share agreements are typically financed by investors or companies who want to dedicate funds to helping workers upskill or launch new careers.

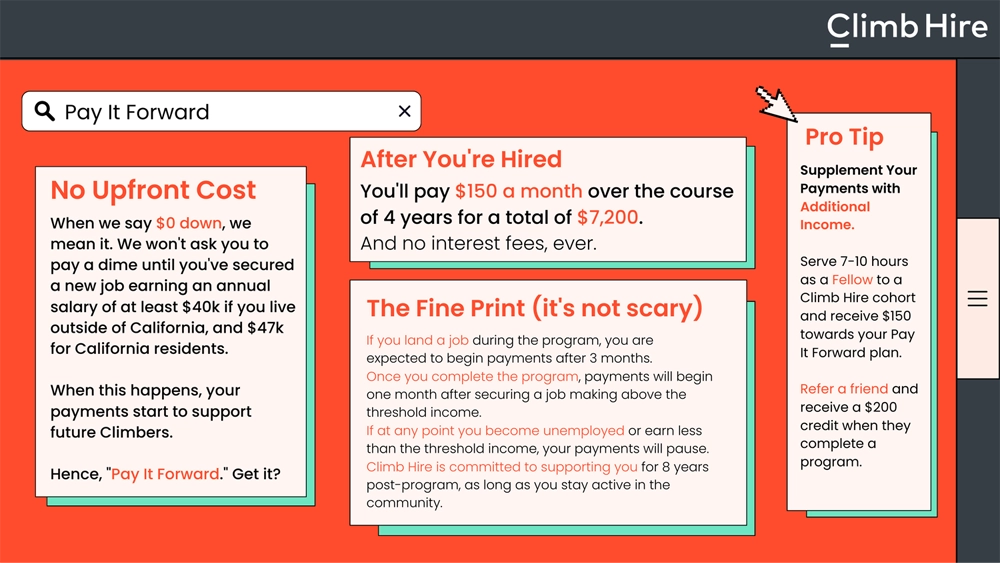

Through those generous investments, companies like Climb Hire are able to provide training programs that are designed to transform our students’ careers. Once you finish the Climb Hire program and start working, you then “pay it forward” by paying a pre-set, affordable monthly payment of $150.

What Are the Benefits of Income Share Agreements?

Most traditional student loans come with high interest rates and large monthly payments once you finish school. The structure can lend itself to being quite rigid and inflexible, and income share agreements have popped up as a viable alternative.

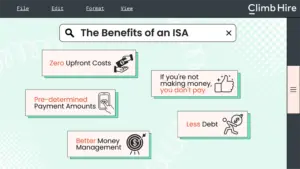

- The benefits of income share agreements include:

- Students can start a new program with zero upfront costs

- Graduates feel secure in the knowledge of what they’ll pay once they find employment

- Students are able to avoid the large amounts of debt historically associated with university education

- The fixed repayment amount allows graduates to better manage their money

- There is a lower amount of risk involved both when signing up for an educational program and after graduation, when some traditional loan borrowers default

At the end of the day, the model we have at Climb Hire is pretty simple. If you don’t make money, you don’t have to pay any money back.

That doesn’t mean we don’t expect you to succeed, though. We’ve found that our employer partners and networking opportunities create an environment in which graduates find meaningful work and are able to pay it forward — a win-win for everyone!

What Should I Know About an ISA Before Agreeing?

While ISAs have a myriad of benefits compared to traditional loans, it’s essential that you do your own research and know exactly what you’re signing up for.

Here are some things to consider when researching a company’s ISA program:

- The total cost of the program: Does the tuition amount seem fair and equitable? While ISA repayments are just an agreed-upon amount, if a company’s total cost of tuition is much higher than other programs, you may still pay more in the long run than you would at another program.

- Length of the program: The longer you’re in school, the longer you aren’t working. You’ll need to account for paying for personal costs during school like rent, groceries, and other bills, so the time you’re not in the workforce matters.

- Applicable interest rates: Again, the interest rates you pay may translate to higher costs over the life of your ISA.

- Detailed repayment schedule: How much will you owe based on different scenarios? At what minimum income level do you start owing a repayment? What is the maximum amount you can be required to repay?

- Typical graduate outcomes: Look at the average salary that program graduates can expect to get an idea of how you’ll fare after the program. This can help you get an idea of how much money you’ll be making after your ISA payments come out each month.

Wondering how Climb Hire’s Pay It Forward program stacks up? Check it out:

Knowledge is power, and gathering this information will help you make a more informed decision when it comes to income share agreements.

Start Your New Career Now

Ready to take the leap into a new industry?

Our grads see an average of a 50% jump in income after completing the Climb Hire program—and you’ll pay nothing back until you land your first role. If that sounds good to you, learn more below!